The Reset: Why We Pivoted (December 2023)

Our original Home Chef Marketplace model was no longer viable. While we were able to acquire customers, retention remained weak and unit economics were strained. At the same time, the broader market had shifted materially. Beginning in 2022, investor appetite for two-sided marketplace models deteriorated rapidly, and the availability of venture capital to subsidize user growth all but disappeared. Paid acquisition became more expensive, less predictable, and increasingly incompatible with a disciplined path to near-term profitability.

In that environment, continuing down the same path would not have been responsible. Left unchanged, the business would have likely shut down.

In December 2023, we made a hard but necessary decision: to pivot Tre’dish into a direct-to-consumer wholesale grocery platform.

This was not a theoretical pivot. It was a deliberate decision to repurpose the technology we had already built and apply it to a problem that had reached a breaking point for consumers. At a time when cost of living and food prices were at all-time highs, the question became simple and urgent: how do you deliver high-quality groceries at meaningfully lower prices, at scale?

That decision marked the beginning of a difficult, but methodical operational build of our wholesale grocery model.

January 2024 to December 2024: Bootstrapping, Experimentation, and Proof of Concept

2024 was about answering one question: could this new model actually work?

To test the pivot, Tre’dish was initially funded by a $1M investment from my family office, alongside a small group of close strategic partners with operational expertise. With limited resources and a tightly constrained capital budget, we operated with extreme scrappiness as we wanted to use limited capex and stay asset light:

Early wholesale relationships with produce and meat suppliers

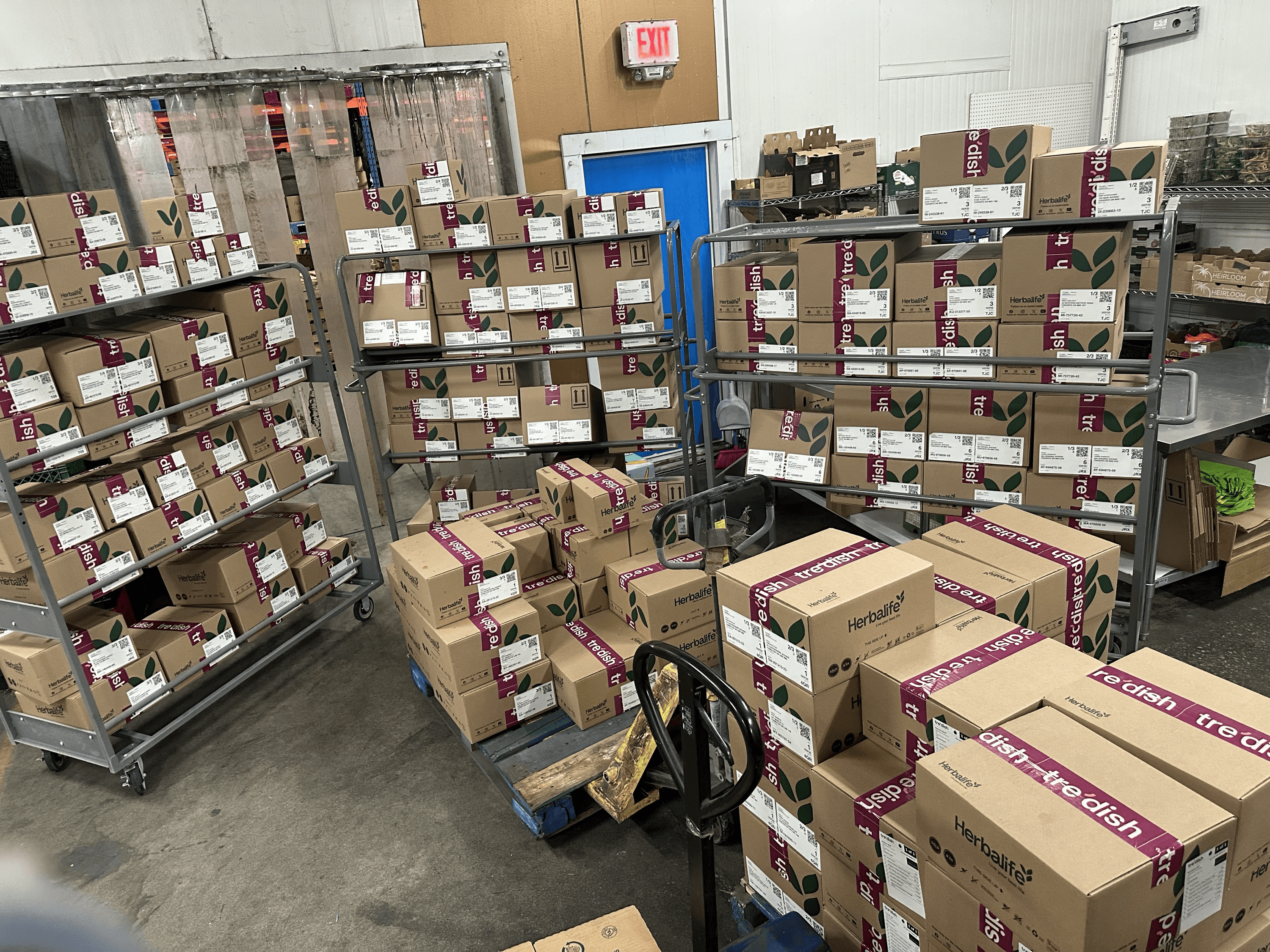

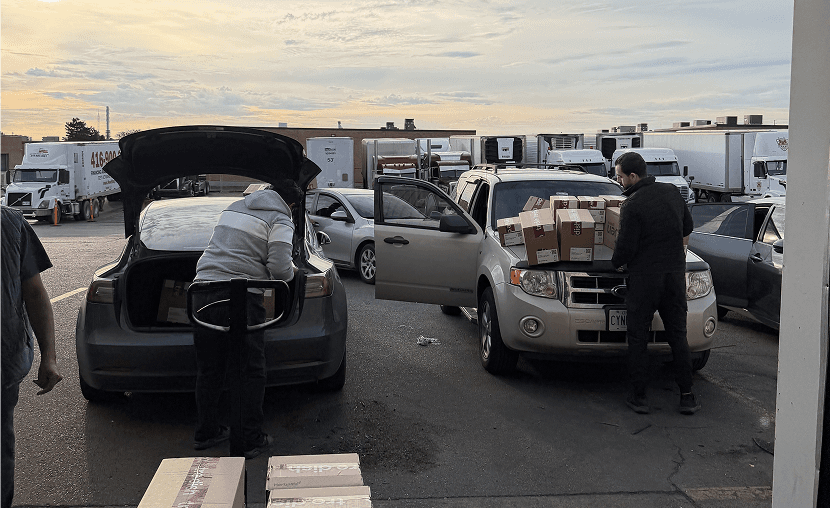

Storage and pick and packing through a third-party electronics warehouse, supported by 2 outdoor refrigerated and freezer trailers

A repurposed app and data engine to acquire and track early customers

Community activation and door-to-door acquisition strategies

The results were mixed, and invaluable.

We proved we could acquire customers and deliver wholesale-priced groceries directly to their doors. At the same time, we uncovered critical execution gaps:

Quality control and fulfillment consistency were not good enough

Delivery experience lacked reliability

Average order value (AOV) hovered around ~$45

Product selection was too limited to represent a full grocery basket

Retention suffered accordingly.

The positive signal, however, was clear. Our technology worked. We began collecting meaningful consumer data sets. And most importantly, the value proposition resonated with customers.

The conclusion was unavoidable: the model was right, but the execution needed to change.

The Foundation Year: Listening and Rebuilding (2025)

If 2024 was about survival and validation, 2025 was about listening.

Customers told us exactly what needed to change:

They wanted to buy all their groceries in one spot, not just a few items

Quality and consistency mattered as much if not more than price alone

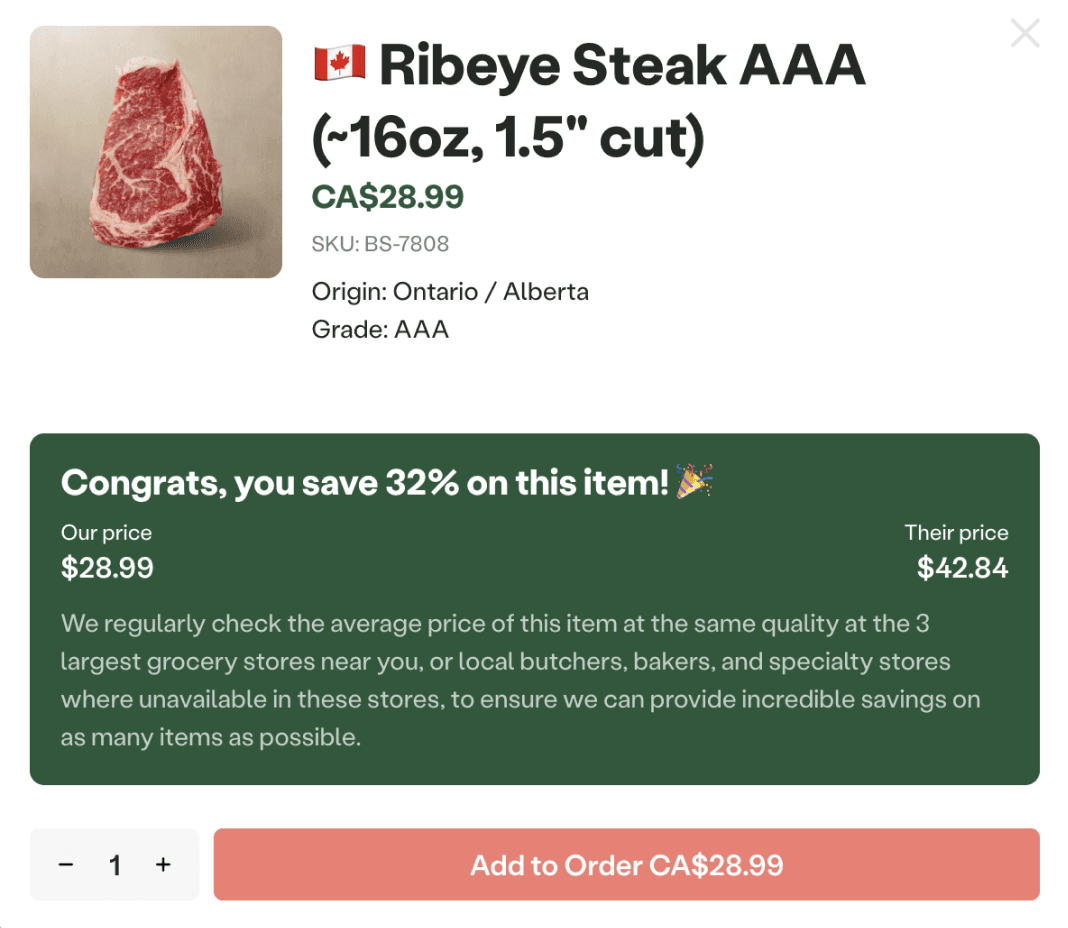

Pricing needed to be open, honest, and transparent relative to their local grocery store

Delivery needed to be predictable and reliable

The experience needed to be simple and repeatable

We rebuilt the business around those truths.

SKU Expansion and Wholesale Access

We acquired Brandco and entered into a strategic agreement with Chen’s Enterprises, expanding our catalog from ~500 SKUs to 4,000+ SKUs with most-favoured-nation pricing.

Operations and Quality Control

We transitioned into a professional facility with full dry, refrigerated, and frozen storage. This materially improved temperature control, quality assurance, and customer satisfaction, driving order error rates to below 1% from an average of 24% in our previous facility.

Transparent Pricing (Core Product Differentiator)

We launched Transparent Pricing, a first-of-its-kind product feature that shows customers real-time price comparisons against their local grocery store at both the SKU and basket level. This made savings visible, often averaging ~25% per order and removed the need for blind trust, reinforcing transparency as a key brand differentiator.

Delivery and Regional Scalability

We partnered with Trexity to expand last-mile delivery reach and implemented a modular node strategy, allowing Tre’dish to enter new regions efficiently using centralized reefer-based pickup points and dense delivery routing.

Acquisition Flywheel Refinement

We continued to test and refine an integrated acquisition approach combining door-to-door, digital, and micro-influencer campaigns. As quality improved, customers came back. Retention increased. Feedback improved. Brand trust began to form.

But one critical insight emerged.

The Breakthrough Insight: A Recurring Grocery Product for Essential, High-Quality Items

By late 2025, we had stabilized customer acquisition costs and built a cohort of high-LTV customers. However, ordering behaviour remained inconsistent. Customers loved Tre’dish, but they ordered sporadically, averaging every ~21 days.

The issue wasn’t demand. It was friction and habit formation.

Customers had to remember to place an order, align with delivery days, and manually rebuild baskets each time. Grocery shopping is habitual, and we were asking customers to rely on memory instead of automation.

The solution became obvious.

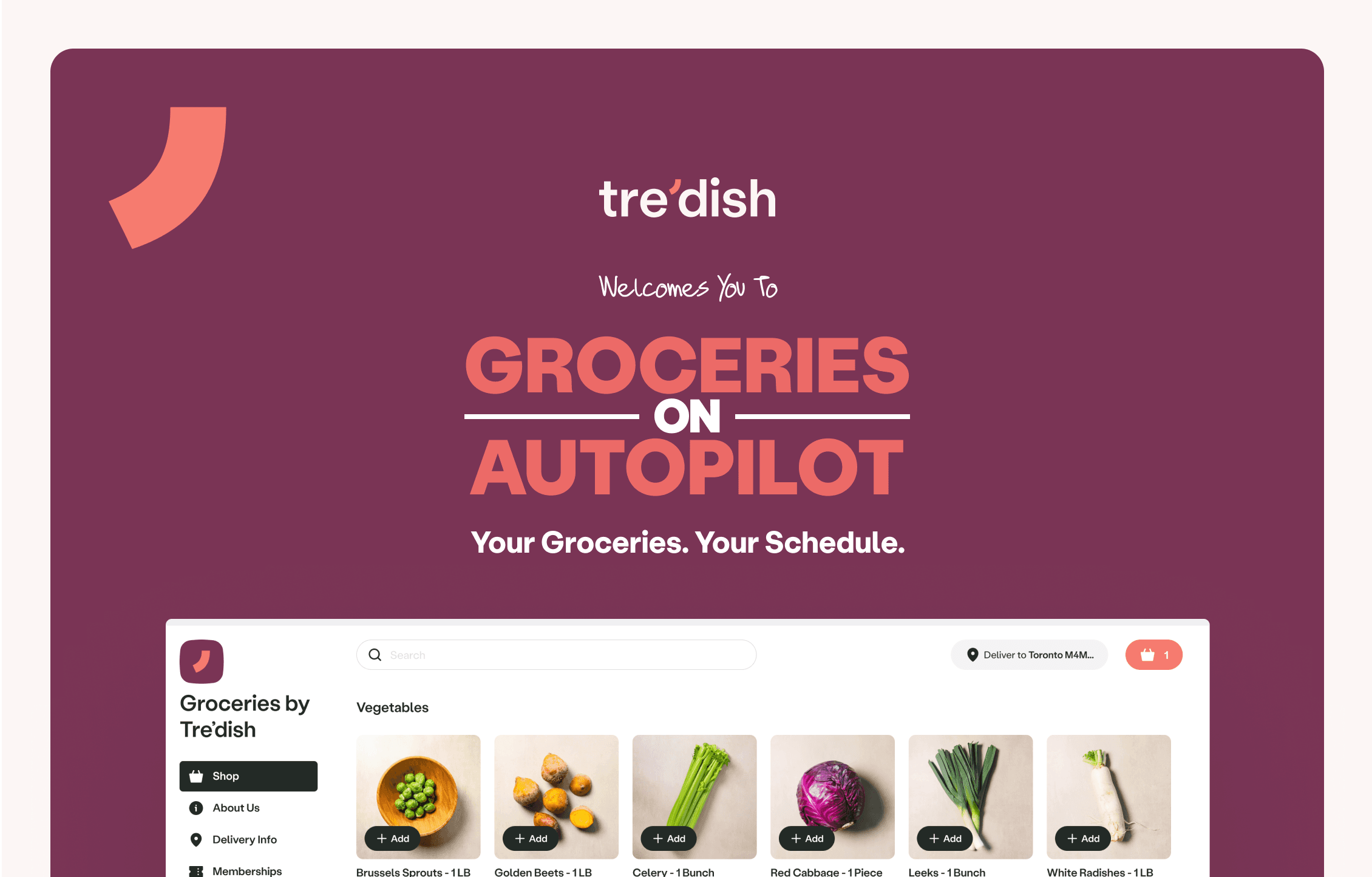

Introducing: Groceries on Autopilot

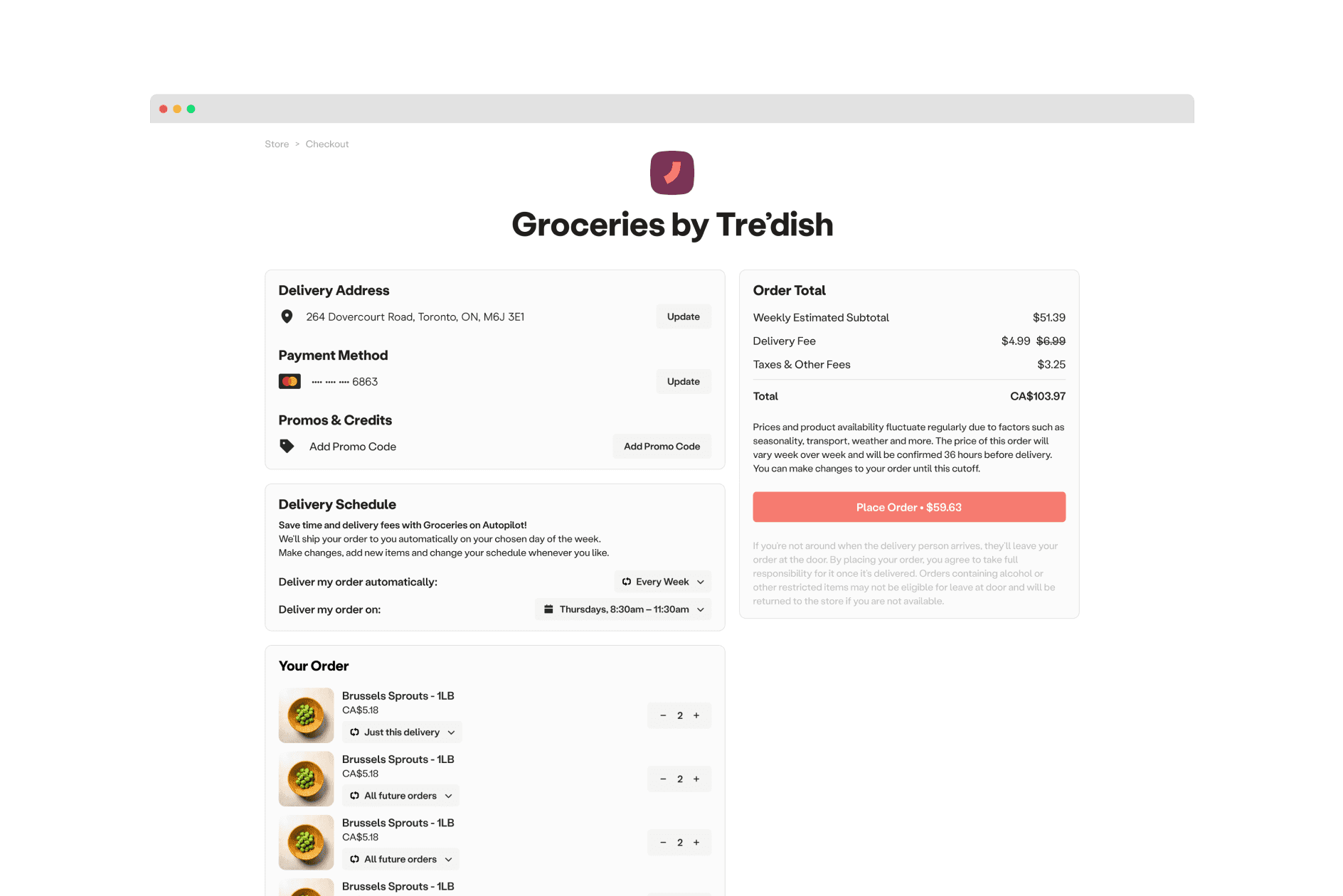

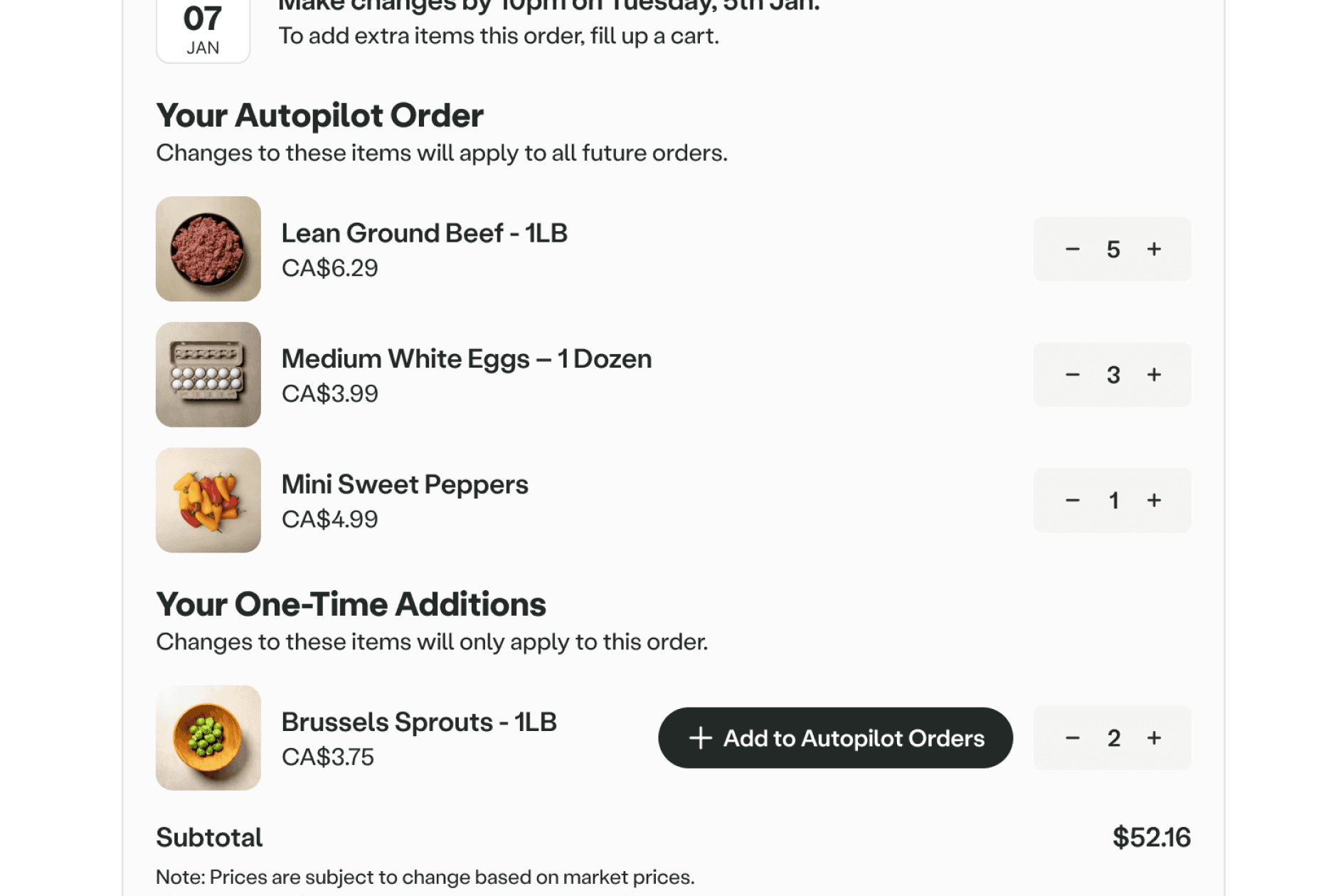

In December 2025, we soft-launched Groceries on Autopilot; a recurring weekly or bi-weekly grocery program focused on essential items including produce, dairy and milk, meat and proteins, and everyday household staples.

The program pairs recurring delivery with an AI-driven recommendation engine that suggests additional items before each shipment, increasing basket size while maintaining convenience.

Early results were encouraging.

Autopilot didn’t just improve retention - it changed customer behaviour.

This insight now defines our strategy.

2026: The Execution Year

2026 is not about reinvention.

It is about execution, scale, and repeatability.

To support this next phase of customer acquisition, marketing, and growth built on a now proven foundational model and platform, we raised a modest $2M round, once again led by my family office with a $1M investment, alongside a select group of additional investors. We intentionally kept this round small to remain capital-efficient and minimize further dilution.

As we execute against our operating plan and work toward our targeted run-rate milestones, we expect to evaluate a Series A growth round. Subject to market conditions and performance, our objective would be to pursue that round at a valuation reflecting a projected step-up of approximately 3x from current levels.

The round remains optionally open, at the company’s discretion, for up to an additional $500,000, capping the total raise at $2.5M. Any additional allocation will be primarily reserved for existing shareholders or strategic investors should they wish to participate.

We are entering the year with:

A validated wholesale model

A dramatically improved customer experience

A clean balance sheet

A clear product-led growth engine

Early Momentum

As we enter 2026, we are beginning to see early indicators that our foundational work is translating into repeatable customer behaviour. To date, more than 1,200 customers have placed three or more orders with Tre’dish, reflecting growing trust in both our product quality and delivery experience.

Less than 30 days after launching Groceries on Autopilot, we have already onboarded 150 recurring customers on weekly or bi-weekly delivery cycles. While still early, these signals reinforce our belief that automation, convenience, and transparency are key drivers of retention and long-term customer value.

Our Singular Focus for 2026

Everything we do this year is oriented around one goal: scaling recurring, repeat-order customers through Groceries on Autopilot.

Key Q1 initiatives starting effective today include:

Expansion across Ontario, beginning immediately with our first major expansion region since launch: Kitchener, Waterloo, Guelph, Cambridge, Grimsby, and Brantford

Regional PR coverage for Autopilot Groceries – CHCH Press Coverage - Wednesday February 28th

A major product feature and AI release focused on personalization and automated reordering for Groceries on Autopilot

Accelerated integrated acquisition campaigns across Door-to-Door, Meta, and influencers

Targets

By Q4 2026, our conservative objectives are:

+ 5,000 active Autopilot customers

+ $1M in monthly recurring revenue (MRR)

These are not aspirational numbers; they are execution benchmarks.

Introduction

Dear Tre’dish Shareholders

Most shareholder updates are written to sound polished, confident, and inevitable. This one is written to be direct and honest.

Our learnings have been incredibly valuable and Tre’dish today looks nothing like the company we were two years ago, and that is intentional. What follows is a candid reflection on the last two years since our pivot: why we pivoted, what we learned the hard way, and why 2026 is the year we believe Tre’dish transitions from survival and validation into focused execution and scalable growth.

Peter Hwang

Closing Thoughts and Our Ask of Shareholders

Tre’dish is not a turnaround story.

It is a build-in-public story.

Two years ago, the business required relentless hands-on execution and constant problem-solving to move forward. Today, we are building a platform intentionally designed for scale. While this has been the most difficult build of my entrepreneurial career, my team and I now have more conviction in the model, the customer response, and the opportunity ahead than ever before. That conviction is reflected not only in words, but in continued personal investment of capital, time, and effort to build long-term shareholder value.

Importantly, we are not asking shareholders for additional funding or investment at this time.

What we are asking for is your support as customers and advocates. The most impactful way to support your investment is to experience the product firsthand and help spread the word to friends, family, and colleagues. Network effects matter deeply in this business, and shareholder participation is one of the strongest signals we can generate.

If you are interested, we would be happy to personally onboard you to Groceries on Autopilot. We will set up a recurring order for you and include a $50 credit so you can experience the service end-to-end, including automated weekly or bi-weekly delivery of essential groceries at an average of ~25% savings, with full flexibility to modify orders easily through our app.

If this is of interest, please email me directly and I will personally coordinate an onboarding session with our team.

Thank you again for your patience, conviction, and continued belief in this journey. We do not take that trust lightly.

Peter Hwang